How Net Worth Is Calculated is a common question for anyone who wants to understand their true financial position. Net worth calculation simply means measuring what you own versus what you owe to see your overall financial health.

This concept is widely used in personal finance, wealth management, and financial planning to track progress over time. Understanding assets, liabilities, and total wealth makes money decisions clearer and more confident.

When learning How Net Worth Is Calculated, it is important to know that it includes all assets such as cash, savings, property, investments, and valuables, minus all debts like loans, mortgages, and credit cards.

This financial formula helps individuals and businesses evaluate financial stability and long term goals. Regular net worth analysis supports smarter budgeting, better investment planning, and improved money management.

How Net Worth Is Calculated

How net worth is calculated is one of the most important concepts in personal finance. As a simple rule, net worth shows your real financial position at a specific time. It helps you understand whether you are building wealth or falling into debt. Financial experts, investors, and even banks use net worth to judge financial strength and stability.

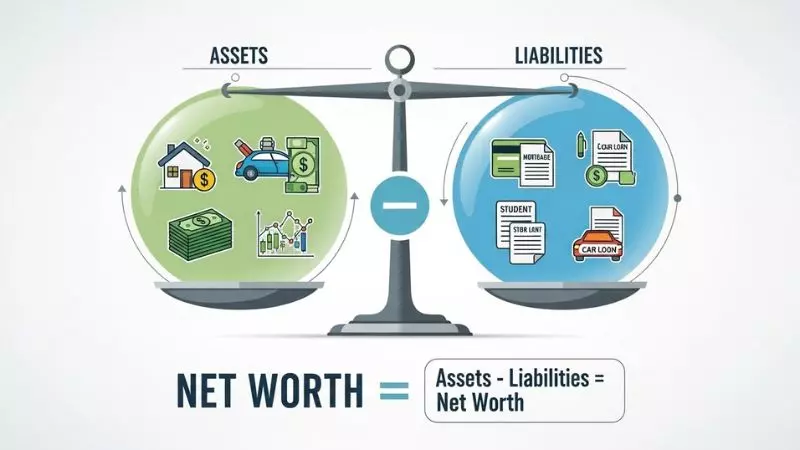

To calculate net worth correctly, you need two main components assets and liabilities.

Assets include cash, savings accounts, property, investments, gold, vehicles, and business value.

Liabilities include loans, credit cards, mortgages, personal debts, and any money you owe.

When assets are higher than liabilities, your net worth is positive, which indicates financial growth. If liabilities are higher, it shows financial risk and the need for better money management.

Key points to remember

- Net worth is a snapshot of your finances, not your income

- It changes over time with spending, saving, and investing

- Regular calculation helps in financial planning and goal setting

How Net Worth Is Calculated in Pakistan

Understanding how net worth is calculated in Pakistan follows the same global principles but includes local financial elements. In Pakistan, assets often include property value, agricultural land, gold savings, prize bonds, bank deposits, and family businesses. Liabilities usually include bank loans, car financing, home loans, and informal debts.

Below is a simple example based on a common Pakistani household.

| Financial Components | Estimated Value PKR |

| Cash and Bank Savings | 800,000 |

| Residential Property | 5,000,000 |

| Gold and Investments | 1,200,000 |

| Total Assets | 7,000,000 |

| Home Loan | 2,500,000 |

| Personal Debt | 500,000 |

| Total Liabilities | 3,000,000 |

| Net Worth | 4,000,000 |

In Pakistan, net worth is also important for visa applications, business partnerships, tax evaluation, and loan approvals. Property and gold play a major role in overall wealth compared to stocks and bonds.

What Is Net Worth of a Person

What is net worth of a person simply means the total value of everything a person owns after subtracting all debts. It does not depend on salary alone. A person earning a high income can still have low or negative net worth if expenses and debts are high.

Net worth reflects financial discipline, saving habits, and investment decisions. It is often used to compare financial progress over time rather than comparing with others.

Why net worth matters

- Shows real financial health

- Helps track wealth building progress

- Supports better budgeting and saving decisions

- Useful for retirement and investment planning

A positive and growing net worth means you are moving in the right financial direction.

Net Worth Formula Balance Sheet

The net worth formula balance sheet method is the most accurate and professional way to calculate net worth. It is commonly used by financial advisors and accountants.

Net Worth Formula

Net Worth = Total Assets minus Total Liabilities

This formula works like a personal balance sheet where assets are listed on one side and liabilities on the other. The difference between the two gives your net worth.

Steps to apply the balance sheet method

- List all assets at current market value

- List all liabilities with outstanding balances

- Subtract liabilities from assets

- Review and update regularly

Using a balance sheet approach helps you clearly see where your money is tied up and where improvements are needed. It also helps in setting realistic financial goals and improving long term financial stability.

How Net Worth Is Calculated Calculator

Net Worth Calculator

Calculate your total assets minus liabilities

Assets

Liabilities

What Is a Good Net Worth

A good net worth depends on age, income level, location, and financial goals. There is no single perfect number, but a good net worth generally means your assets are growing faster than your liabilities. Financial experts often suggest that your net worth should increase steadily as you age, showing financial stability and smart money habits.

Key factors that define a good net worth include savings rate, investments, debt control, and asset growth. A positive net worth at any age is a strong sign of financial health. For long term success, the focus should be on consistent improvement rather than comparison with others.

General indicators of a good net worth

- Positive net worth with manageable debt

- Emergency savings available

- Investments aligned with future goals

- Assets growing year by year

How to Calculate Net Worth of a Company

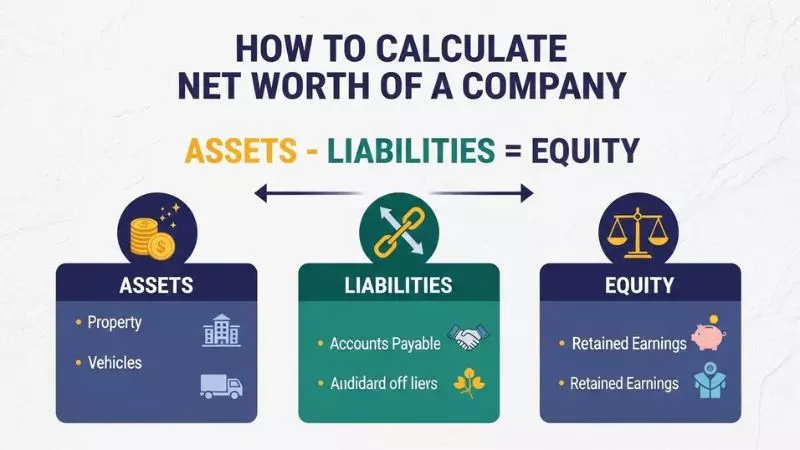

How to calculate net worth of a company is an important concept in accounting, business valuation, and financial analysis. A company’s net worth shows its actual financial strength and is commonly used by investors, lenders, and stakeholders.

Company net worth is calculated by subtracting total liabilities from total assets as shown in the company’s financial records.

| Company Financial Elements | Amount |

| Total Assets | Cash, inventory, property, equipment |

| Total Liabilities | Loans, payables, obligations |

| Company Net Worth | Total Assets minus Total Liabilities |

Company net worth is also known as shareholder equity or owners equity. A higher net worth indicates strong financial stability and business growth potential.

Liquid Net Worth

Liquid net worth refers to the portion of net worth that can be quickly converted into cash without significant loss in value. It is an important measure of financial flexibility and short term security.

Liquid assets include cash, bank balances, fixed deposits, mutual funds, and stocks. Illiquid assets like property, land, and long term investments are excluded from liquid net worth.

Why liquid net worth matters

- Helps handle emergencies easily

- Supports quick investment opportunities

- Improves financial confidence

- Reduces dependence on loans

A strong liquid net worth means you can meet financial needs without selling long term assets.

Net Worth On

The term net worth on is commonly used when referring to net worth on a specific date, platform, or financial statement. It shows a snapshot of financial position at a particular time.

Net worth on a certain date is useful for loan applications, audits, business reviews, and personal financial tracking. It helps compare financial progress between different periods and supports better financial decisions.

Common uses of net worth on

- Net worth on balance sheet date

- Net worth on company records

- Net worth on financial statements

- Net worth on a specific financial year

How Net Worth Is Calculated in India

How net worth is calculated in India follows the same global formula but includes region specific assets and liabilities. In India, assets commonly include real estate, gold, bank savings, fixed deposits, mutual funds, shares, provident fund, and business interests. Liabilities include home loans, personal loans, credit cards, and business debts.

Net worth calculation in India is widely used for financial planning, bank loans, visa applications, and business valuation. Property and gold often form a major part of total assets in Indian households.

Basic steps in India

- Add total assets at current market value

- Add total liabilities outstanding

- Subtract liabilities from assets

- Review annually for accuracy

How Net Worth Is Calculated From Balance Sheet in India

How net worth is calculated from balance sheet in India is a standard accounting method used by companies and professionals. The balance sheet clearly shows assets, liabilities, and equity.

Net worth from a balance sheet is calculated as shareholders equity, which represents the residual value after all liabilities are deducted from assets.

Balance sheet based formula

- Net Worth equals Total Assets minus Total Liabilities

- Equity capital plus reserves minus accumulated losses

This method is commonly used for audits, company registration, financial reporting, and investment analysis. It provides a clear and legally accepted measure of financial strength.

How Net Worth Is Calculated Schedule 1

How net worth is calculated Schedule 1 is commonly asked in legal, immigration, and financial disclosure cases. Schedule 1 usually refers to a formal statement where assets and liabilities are listed in an organized format to determine an individual’s or entity’s net worth. The purpose is to present a clear, verifiable picture of financial standing.

In Schedule 1, assets such as cash, bank balances, property, investments, and valuables are listed first. Liabilities like loans, credit obligations, and outstanding payments are then deducted. The final figure shown at the bottom of Schedule 1 is the net worth, which represents true financial capacity at the time of filing.

Typical items included

- Cash and bank accounts

- Real estate and investments

- Business interests and valuables

- Loans, mortgages, and other debts

Help Me Understand How Net Worth Is Calculated

To help you understand how net worth is calculated, think of it as a simple financial checkup. You list everything you own and subtract everything you owe. The result tells you whether you are financially strong or need improvement.

Simple steps

- Write down all assets at current value

- List all liabilities with outstanding amounts

- Subtract total liabilities from total assets

- The remaining amount is your net worth

This calculation is not about income or salary. It focuses on overall wealth and financial position at a specific point in time.

How Is Your Net Worth Calculated

How is your net worth calculated depends on your personal financial situation, but the method is always the same. All personal assets are added together, and all personal debts are subtracted.

Common personal assets

- Cash and savings

- Property and vehicles

- Investments and retirement funds

Common personal liabilities

- Home loans and car loans

- Credit card balances

- Personal and business debts

Your net worth changes as you save more, invest wisely, or reduce debt. Tracking it regularly helps you stay in control of your finances.

Explain What Net Worth Is Used For and How It Is Calculated

Net worth is used to measure financial health, plan future goals, and make informed financial decisions. Banks, investors, and financial institutions rely on net worth to assess risk and credibility. Individuals use it to track progress toward financial freedom.

Uses of net worth

- Loan and credit approval

- Investment and retirement planning

- Business valuation and audits

- Immigration and legal documentation

How it is calculated

Net worth is calculated by subtracting total liabilities from total assets. This basic formula applies to individuals, businesses, and organizations worldwide. Understanding this concept allows better money management, smarter planning, and long term financial stability.

How Is Net Worth Calculated for Celebrities

How is net worth calculated for celebrities is based on publicly available financial data, industry estimates, and asset valuation. Celebrities earn income from movies, music, sports, brand endorsements, businesses, and investments. Their net worth reflects total wealth, not just yearly income.

Celebrity net worth is usually estimated by financial analysts using known earnings, property holdings, company stakes, royalties, and luxury assets, minus taxes, management costs, and liabilities.

Key components used

- Income from films, shows, concerts, or sports

- Brand endorsements and sponsorship deals

- Real estate, businesses, and investment portfolios

- Debts, loans, and ongoing expenses

Because private financial details are not fully public, celebrity net worth figures are estimates, not exact numbers.

How Does Net Worth Is Calculated

How does net worth is calculated follows a universal financial rule used across the world. Net worth represents the difference between what a person or entity owns and what they owe at a specific time.

Basic calculation process

- Add the total value of all assets

- Add the total outstanding liabilities

- Subtract liabilities from assets

This method applies to individuals, businesses, celebrities, and organizations. It helps determine financial strength and long term stability.

How Mukesh Ambani Net Worth Is Calculated

How Mukesh Ambani net worth is calculated is mainly based on his ownership in Reliance Industries and other business interests. His net worth is not measured by salary but by the market value of his shareholding in publicly traded companies.

Financial analysts calculate his net worth by evaluating his percentage ownership in Reliance Industries, adding the value of private investments, real estate, and other assets, then adjusting for liabilities.

| Major Wealth Sources | Description |

| Reliance Industries Shares | Market value based on stock price |

| Subsidiary Businesses | Retail, telecom, energy holdings |

| Real Estate Assets | Residential and commercial properties |

| Other Investments | Private equity and global assets |

His net worth changes daily due to stock market movements, making it dynamic rather than fixed.

How Tangible Net Worth Is Calculated

How tangible net worth is calculated focuses only on physical and measurable assets. Intangible assets such as goodwill, patents, trademarks, and brand value are excluded from this calculation.

Tangible Net Worth Formula

Tangible Net Worth = Total Assets minus Intangible Assets minus Total Liabilities

Examples of tangible assets

- Cash and bank balances

- Property, land, and buildings

- Machinery, equipment, and vehicles

- Inventory and physical investments

Tangible net worth is commonly used by banks and lenders to assess creditworthiness because it reflects real, saleable value. It provides a conservative and reliable view of financial strength.

Frequently Asked Questions

How is net worth calculated?

Net worth is calculated by subtracting total liabilities from total assets to show your overall financial position.

What assets are included in net worth?

Assets include cash, bank accounts, real estate, investments, vehicles, and valuable possessions.

What liabilities are included in net worth?

Liabilities include loans, mortgages, credit card debt, and any money owed to others.

How often should net worth be calculated?

Net worth should be calculated at least once a year or whenever significant financial changes occur.

How does net worth differ from income?

Income is what you earn over time, while net worth measures total wealth at a specific point.

How is net worth calculated for companies?

For companies, net worth is total assets minus total liabilities, also known as shareholder equity.

What is liquid net worth?

Liquid net worth includes only assets that can quickly be converted into cash, excluding property or long-term investments.

How is net worth calculated from a balance sheet?

Net worth is calculated from a balance sheet by subtracting total liabilities from total assets.

Can net worth be negative?

Yes, if liabilities exceed assets, the net worth is negative, indicating financial instability.

How does net worth help in financial planning?

Net worth helps track wealth, manage debt, plan investments, and set realistic financial goals.

Final Words

Understanding How Net Worth Is Calculated allows individuals and businesses to evaluate financial health and track wealth growth over time. Regular net worth assessment helps in smarter budgeting, debt management, and achieving long-term financial goals.

Hi, I’m Emily Carter, the mind and heart behind CaptionMood — a creative space designed to help you express your thoughts with the perfect words.

As a writer and digital content enthusiast, I’ve always believed that captions are more than just text; they’re emotions, stories, and reflections of who we are. With CaptionMood, my mission is to provide unique and engaging Mood Captions, Occasion Captions, and Social Media Captions that resonate with people from all walks of life.

Thank you for visiting and being part of this journey. Through CaptionMood, I hope to inspire, connect, and make every post more meaningful.